SMSF Services

SMSF Administration Services – Helping You Manage Your Super with Confidence

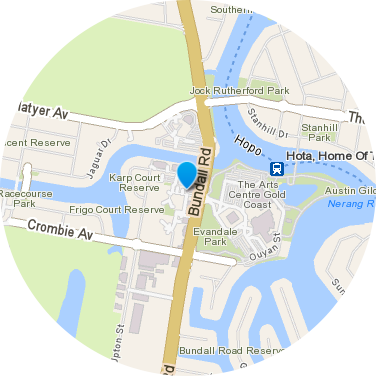

Managing a Self-Managed Super Fund (SMSF) comes with great financial benefits, but it also involves complex rules and ongoing compliance requirements. Our Gold Coast-based accounting firm makes SMSF administration easy, ensuring you stay on top of your obligations while focusing on growing your wealth.

Our SMSF Services Include:

- Annual Compliance & Tax Returns – We handle your SMSF’s financial statements, tax returns, and compliance reporting, making sure everything is lodged correctly and on time.

- Audit Coordination – SMSFs require an annual independent audit. We liaise with trusted auditors to ensure your fund meets all regulatory requirements.

- Contribution & Pension Management – Whether you’re making contributions or drawing a pension, we help you structure payments to stay within the rules and maximize tax benefits.

- Investment Compliance Support – We guide you in keeping your SMSF investments compliant with Superannuation Laws, avoiding costly mistakes.

- BAS & GST Lodgements – If your SMSF is registered for GST, we take care of Business Activity Statement (BAS) lodgements.

- General Advice & Ongoing Support – Got a question about your SMSF? We provide practical advice on administration and compliance matters, keeping you informed and stress-free.

By partnering with us, you get expert support to ensure your SMSF is fully compliant and efficiently managed. Let us handle the paperwork while you focus on securing your financial future.

📞 Contact us today to discuss how we can help with your SMSF!

Digitally enhanced by

Digitally enhanced by