Hi there my fellow business owners,

If you have been keeping up to date with my blogs, by now you have your business forecasts in place, so now we will move on to stock…

Do you find yourself struggling to manage your stock? Are you holding too much stock? Or maybe you’ve been caught out not having enough?

They key here is to identify the optimum amount of stock you need to carry. It makes sense that you should hold the minimum amount of stock possible, but at the same time you need to make sure you have enough to satisfy your peak demand times.

It can be a tricky equation to master, but it’s far from impossible.

Here’s some key things to keep in mind to help you master the equation…

- Your demand in units per month / year. This can be identified from your forecasting. If you skipped Step 1 (Forecasting) go back now. I told you it was important. 🙂

- Your fixed costs per month / year. The costs associated with your orders, the amount you spend on procuring stock. For example, orders fees, inspections and so on.

- Your carrying costs per unit per month / year. These are the expenses you pay to hold and maintain your inventory. Things like storage, utilities and insurance.

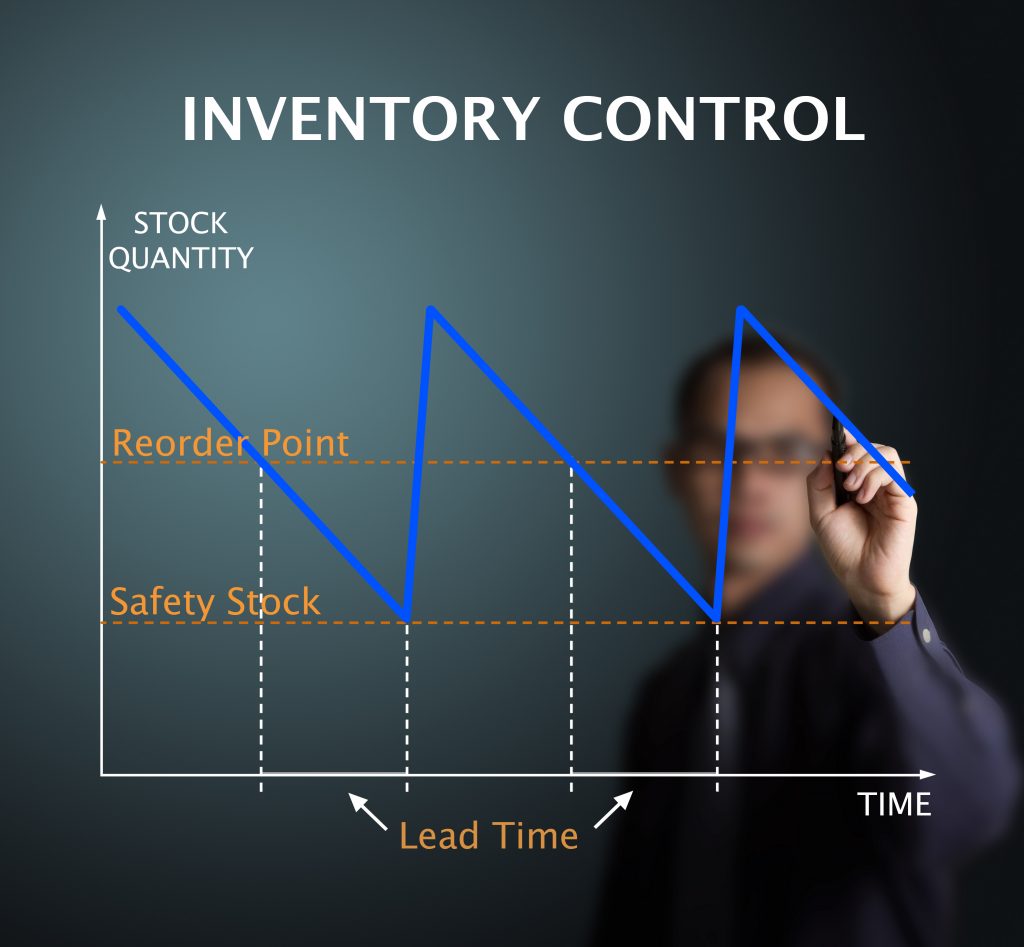

- Your lead time. Lead time is how long it takes you to receive new stock after you have placed the order. Remember to factor in this waiting time and make sure you have it covered with sufficient stock on hand.

- Think about safety stock. This is a just in case buffer. Stock that you carry to protect your business against unpredictable events such as a surge in demand or a break down in the supply chain. It can and does happen!

- Know your re-order point. Correct setting of your re-order points helps you two-fold. It cuts down on excess spending (cash flow is king) and it provides you with a buffer for any unexpected turns.

Now you have worked out your optimum stock level, it is a good time to review your pricing. This is because you have done your forecasting and have a much deeper understanding of the costs involved with your stock management. You may well find your true profit margin on sales isn’t what you thought.

Clear as mud? If you want to make sure you’re on the right track with it reach out & give me a call or email. I’m here to help you out.

Mick

07 5646 4050

P.S. I cover this & 7 other key tips in my free Small Business Guide “How to Eliminate Your Small Business Cash Flow Gaps for Good”. You can download it here: https://www.ignitionaccountants.com.au/

Digitally enhanced by

Digitally enhanced by