Hi there fellow business owners,

Coming up to the end of the financial year it’s time to get started on the tax planning and if you haven’t already done so. So today I am going to work through it and make sure you don’t miss anything for you.

Here’s a guide to the strategies you can use to minimize your business tax.

TEMPORARY FULL EXPENSING FOR ASSET PURCHASES

Businesses with an aggregated turnover of less than $5 billion can immediately deduct the business portion of the cost of eligible new depreciating assets. For businesses with an aggregated turnover of less than $50 million, temporary full expensing also applies to the business portion of eligible second-hand depreciating assets.

SUPERANNUATION

The concessional superannuation cap for 2022 is $27,500 for all individuals. Do not go over this limit or you will pay more tax! Note that employer super guarantee contributions are included in these caps. Where a concessional contribution is made that exceeds these limits, the excess is included in your assessable income and taxed at your marginal rate, plus an excess concessional contributions charge.

To claim a tax deduction in the 2022 financial year, you need to ensure that your employee superannuation payments are received by the super fund or the Small

Business Superannuation Clearing House (SBSCH) by 30 June 2022. You should avoid making last minute superannuation payments as processing delays may cause them to be received after year-end. If for any reasons you end up having to make last minute payments and you would like to claim them as deductions for the current year, contact us immediately and before you make any payments for possible resolutions.

TOOLS OF TRADE / FBT EXEMPT ITEMS

The purchase of Tools of Trade and other FBT-exempt items for business owners and employees can be an effective way to buy equipment with a tax benefit. Items that can be packaged include handheld/portable tools of the trade, computer software, notebook computers, personal electronic organizers, digital cameras, briefcases, protective clothing, and mobile phones. If structured correctly, the employer will be entitled to a tax deduction for the reimbursement payment to the employee (for the equipment cost), claim any GST input credit, and the employee’s salary package will only be reduced by the GST-exclusive cost of the items purchased. You should buy these items before 30 June 2022.

REPAIRS & MAINTENANCE

Make payments for repairs and maintenance (business, rental property, employment) BEFORE 30 June 2022.

DEFER INCOME

If possible, defer issuing further invoices and receiving cash/debtor payments until after 30 June 2022. This strategy pushes tax payable to future years.

MOTOR VEHICLE LOGBOOK

Ensure that you have kept an accurate and complete Motor Vehicle Logbook for at least a 12-week period. The start date for the 12-week period must be on or before 30 June 2022. You should make a record of your odometer reading as of 30 June 2022 and keep all receipts/invoices for motor vehicle expenses. An alternative (with no log book needed) is to simply claim up to 5,000 business kilometers (based on a reasonable estimate) using the cents per km method.

INVESTMENT PROPERTY DEPRECIATION

If you own a rental property and haven’t already done so, arrange for the preparation of a Property Depreciation Report to allow you to claim the maximum amount of depreciation and building write-off deductions on your rental property.

DEFER INVESTMENT INCOME & CAPITAL GAINS

If possible, arrange for the receipt of Investment Income (e.g. interest on Term Deposits) and the Contract Date for the sale of Capital Gains assets, to occur AFTER 30 June 2022. The Contract Date is generally the key date for working out when a sale occurred, not the Settlement Date!

YEAR-END STOCKTAKE / WORK IN PROGRESS

If applicable, you need to prepare a detailed Stock Take and/or Work in Progress listing as at 30 June 2022. Review your listing and write off any obsolete or worthless stock items.

WRITE-OFF BAD DEBTS

Review your Trade Debtors listing and write off all bad debts BEFORE 30 June 2022. Prepare a management meeting document listing each bad debt, as evidence that these amounts were written off prior to year-end, and enter these into your accounting system before 30 June 2022.

PRIVATE COMPANY (“DIV 7A”) LOANS

Business owners who have borrowed funds from their company in previous years must ensure that the appropriate principal and interest repayments are made by 30 June 2022. Current year loans must be either paid back in full or have a loan agreement entered in before the due date of lodgment for the company return, or risk having it counted as an unfranked dividend in the return of the individual.

There is a guide to get all the measures implemented before the end of the financial year watch it HERE

Book a call HERE to get in touch with us TODAY before the 30 June 2022 deadline for assistance to reduce your tax.

Download Personal and Business Tax Guide.

Mick

I’d love to help you achieve your business dreams, please don’t hesitate to contact me;

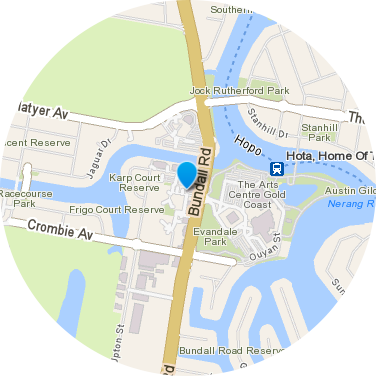

07 5646 4050

mick@ignitionaccountants.com

Digitally enhanced by

Digitally enhanced by